Understanding the Elliott Wave Principle

The Elliott Wave Principle is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors.

Elliott Wave Pattern Visualizer

- Impulse Waves (1-5): Directional moves

- Corrective Waves (A-C): Counter-trend moves

- Wave 3 is never the shortest

- Wave 4 doesn't overlap Wave 1

Ralph Nelson Elliott (1871-1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves.

Core Principles

Elliott discovered that stock markets, thought to behave in a somewhat chaotic manner, actually traded in repetitive cycles. He found that these cycles resulted from investors' reactions to outside influences, or predominant psychology of the masses at the time.

Elliott stated that "because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable."

Historical Development

Elliott isolated thirteen patterns of movement, or "waves," that recur in market price data and are repetitive in form, but are not necessarily repetitive in time or amplitude. He named, defined and illustrated the patterns.

He then described how these structures link together to form larger versions of those same patterns, how they in turn link to form identical patterns of the next larger size, and so on. In a nutshell, then, the Wave Principle is a catalog of price patterns and an explanation of where these forms are likely to occur in the overall path of market development.

Practical Uses

Although it is the best forecasting tool in existence, the Wave Principle is not primarily a forecasting tool; it is a detailed description of how markets behave. Nevertheless, that description does impart an immense amount of knowledge about the market's position within the behavioral continuum and therefore about its probable ensuing path.

The primary value of the Wave Principle is that it provides a context for market analysis. This context provides both a basis for disciplined thinking and a perspective on the market's general position and outlook.

Elliott Wave Lessons

Explore our comprehensive lessons that cover all aspects of the Elliott Wave Principle, from basic concepts to advanced applications.

Lesson 1: Introduction to the Wave Principle

Discover the fundamental concepts behind Elliott's discovery and how it applies to market behavior and social trends.

Lesson 2: Details of the Complete Cycle

Learn about the five waves up and three waves down that form a complete cycle of eight waves and how they repeat at all degrees.

Lesson 4: Motive Waves

Understand motive waves which subdivide into five waves and always move in the same direction as the trend of one larger degree.

Elliott Wave Patterns

The Elliott Wave Principle identifies several specific patterns that appear repeatedly in market price movements. These patterns provide clues about what might happen next in the market.

Impulse Waves

An impulse wave is a five-wave pattern in the direction of the main trend. It is the most common motive wave and the easiest to spot in a market. Impulse waves consist of five sub-waves that move net in the same direction as the trend of the next larger degree.

- Wave 2 never retraces more than 100% of Wave 1

- Wave 3 is never the shortest among Waves 1, 3, and 5

- Wave 4 does not overlap into the price territory of Wave 1 (in cash markets)

- Wave 4 typically retraces 38.2% or less of Wave 3

- Wave 5 often ends when volume starts to decline

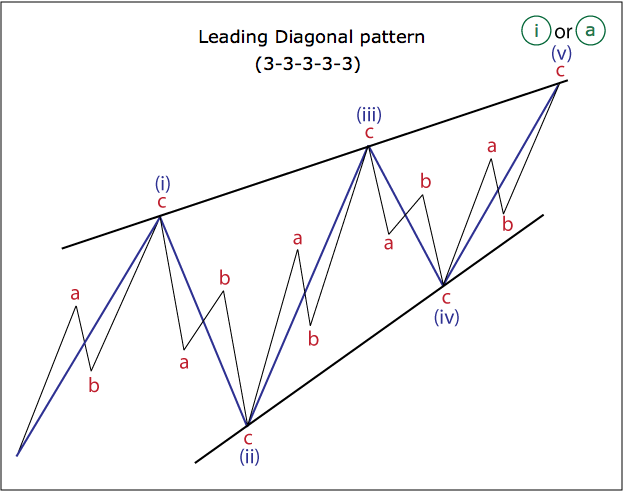

Diagonal Triangles

A diagonal triangle is a motive pattern yet not an impulse, as it has one or two corrective characteristics. Diagonals are subdivided into five waves with an "wedge" shape, where the trendlines converge. They appear as either leading or ending diagonals.

- Subwaves 1, 3, and 5 are typically zigzags

- Wave 4 almost always moves into the price territory of Wave 1

- The trendlines converge in a wedge shape

- Ending diagonals are much more common than leading diagonals

- Often occurs in Wave 5 of an impulse or Wave C of a correction

Fibonacci Relationships in Elliott Waves

The Fibonacci sequence and its ratios appear throughout Elliott Wave patterns, providing key relationships between waves and potential price targets.

Common Retracement Levels

After an impulse wave, corrections typically retrace a Fibonacci percentage of the prior wave:

- 38.2% - Shallow correction

- 50% - Moderate correction

- 61.8% - Deep correction

Wave Relationships

Common Fibonacci relationships between waves:

- Wave 3 = 161.8% of Wave 1

- Wave 5 = 61.8% or 100% of Wave 1

- Wave 2 = 50% or 61.8% of Wave 1

- Wave 4 = 38.2% of Wave 3

Fibonacci Time Zones

Fibonacci numbers can also project potential turning points in time:

- 5, 8, 13, 21, 34, 55, 89 days/weeks/months

- Important tops/bottoms often occur near these intervals

- Combine with price analysis for stronger signals

Learning Resources

Expand your knowledge with these recommended books, tools, and additional resources for mastering the Elliott Wave Principle.

The Elliott Wave Principle

By A.J. Frost and Robert Prechter - The definitive text on the Wave Principle, covering both basics and advanced concepts.

Mastering Elliott Wave

By Glenn Neely - A comprehensive guide that builds on the original theory with additional rules and guidelines.

Elliott Wave Analyzer

Professional software for identifying and projecting Elliott Wave patterns with advanced recognition algorithms.

TradingView

Web-based charting platform with Elliott Wave tools and a community of wave analysts sharing ideas.

Elliott Wave International

The largest independent financial analysis firm offering Elliott Wave education and market forecasts.

WaveCount Forum

Active discussion forum where traders share wave counts and analysis across all markets.